Overview

The Finance and Investment BSc course at DMU provides a rigorous academic approach to finance with a focus on practical skills and employability. Students will be equipped with the advanced technical skillset, knowledge, and professional attitude necessary to excel in a career in the financial sector. The course is a member of the Chartered Financial Analysts (CFA) Affiliation Program and our curriculum well-prepares students to sit the CFA examinations to obtain one of the most reputable professional qualifications in the finance and investment industry.

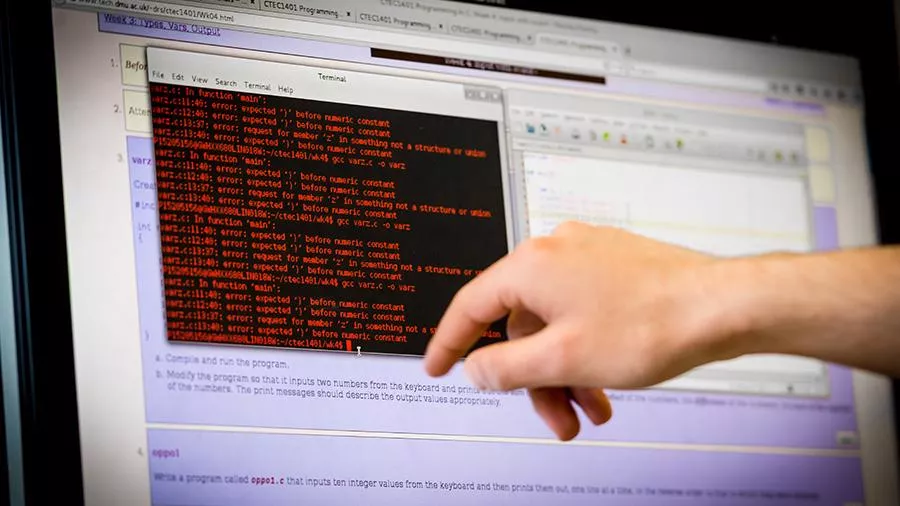

On this course, you will develop a comprehensive understanding of finance through exploration of the connected disciplines of accounting and economics. This programme is ideal for those interested in a mathematical approach, where strong emphasis is placed on quantitative data. The use of important industry-standard commercial databases and software, such as Bloomberg, Thomson Reuters Eikon, Matlab, and Python, are integrated into teaching to bridge the theoretical and practical aspects of finance.

Innovative modules will introduce you to new methodologies – such as Artificial Intelligence and Financial Applications, where you will gain hands-on experience of using, evaluating, and even developing your own AI applications, to solve real-life problems.

Key features

Be equipped with an advanced technical skillset and professional attitudes to develop your career in finance and investment.

Benefit from broad module content covering topics in finance, accounting, and economics.

Experience a ‘state-of-the-art’ module Artificial Intelligence and Financial Applications, which will introduce you to the new methodology revolution. You will have hands-on experience of using and evaluating AI applications, as well as developing your own applications to solve real-life problems.

Study a programme which is structured to address many of the competency requirements of professional Finance bodies. We are proud to be a member of the CFA Affiliation Program.

As a member of the CFA Affiliation Program, we can award the CFA Program Awareness Scholarships to a number of our top-performing students every year.

Benefit from Education 2030, where a simplified ‘block learning’ timetable means you will study one subject at a time and have more time to engage with your learning, receive faster feedback and enjoy a better study-life balance.